(1)

| On May 11, 2022, we granted each of our non-employee directors 724 restricted stock units with a grant date fair value of $249,925,1.On May 11, 2023, we granted each of our non-employee directors 643 restricted stock units with a grant date fair value of $249,883, computed in accordance with FASB ASC Topic 718. These restricted stock units vest and will be settled in shares on the first anniversary of the grant date. No options to purchase shares of our common stock were granted to our non-employee directors in 2023. 2.The following table shows the aggregate shares underlying outstanding common stock options and restricted stock units, based upon grants made as director compensation, held by non-employee directors as of December 31, 2023. | | | | | | | | | | | | | Name | Number of Stock Options (#) | Number of Stock Awards (#) | | | | | | | Glenn A. Carter | 15,000 | | 643 | | | | Brenda A. Cline | 10,000 | | 643 | | | | Ronnie D. Hawkins | — | | 643 | | | | Mary L. Landrieu | — | | 643 | | | | Daniel M. Pope | — | | 643 | | | | Dustin R. Womble | — | | 643 | | |

| | | | | | | | | Operations of the grant date. No options to purchase sharesBoard | | Table of our common stock were granted to our non-employee directors in 2022.Contents |

(2)

| The following table shows the aggregate shares underlying outstanding common stock options and restricted stock units, based upon grants made as director compensation, held by non-employee directors as of December 31, 2022. |

| | Glenn A. Carter | | | 17,000 | | | 724 | | | | Brenda A. Cline | | | 10,000 | | | 724 | | | | Ronnie D. Hawkins | | | — | | | 724 | | | | Mary L. Landrieu | | | — | | | 724 | | | | Daniel M. Pope | | | 3,334 | | | 724 | | | | Dustin R. Womble | | | 1,231 | | | 724 | |

Director & Officer Liability Insurance Directors are covered under our director and officer liability insurance for claims alleged in connection with their service as directors. We have entered into indemnification agreements with all of our directors, agreeing to indemnify them to the fullest extent permitted by law for claims alleged in connection with their service on the Board. Communications with Our Board of Directors Any shareholder or interested party who wishes to communicate with our Board of Directors or any specific director(s), including non-management director(s), may write to: Board of Directors

Tyler Technologies, Inc.

5101 Tennyson Parkway

Plano, Texas 75024 Depending on the subject matter, management will: • | •Forward the communication to the director or directors to whom it is addressed (for example, if the communication received relates to our “whistleblower policy” found on our website, www.tylertech.com, including questions, concerns, or complaints regarding accounting, internal accounting controls, and auditing matters, it will be forwarded by management to the Chair of the Audit Committee for review); •www.tylertech.com, including questions, concerns, or complaints regarding accounting, internal accounting controls, and auditing matters, it will be forwarded by management to the Chair of the Audit Committee for review); |

Attempt to handle the inquiry directly (for example, if the communication is a request for information about us or our operations or it is a stock-related matter that does not appear to require direct attention by our Board of Directors); and/or •Not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. At each meeting of our Board of Directors, our BoardExecutive Chair will present a summary of all communications received since the last meeting of the Board of Directors that were not forwarded and will make those communications available to any director on request. | | | | | | | | | | 41 | | | | | | | | 28

| | | | | | 20232024 Proxy Statement

| |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSCertain Relationships and Related TransactionsOur directors and executive officers seek approval from the Board of Directors prior to entering into a business arrangement that may be deemed a conflict of interest as described in our Code of Business Conduct and Ethics. Examples of transactions that may be considered a conflict of interest include: •to receive from or give to anyone that has a business relationship with us something with more than a token value; •to lend to or borrow from individuals or concerns that do business with or compete with us, except banks and other financial institutions; •to serve as an officer, director, employee, or consultant of, or receive income from, any enterprise doing business with or competing with us; •to own an interest in or engage in the management of an organization providing services or products to us, or to which we sell or compete, except when such interest (a) comprises publicly traded securities listed on a national securities exchange or the OTC margin list and (b) is not in excess of 5% of the securities of such company; and •to knowingly cause, either directly or indirectly, us to enter into a business transaction with a close relative of the director or executive officer or a business enterprise of such relative. In addition, we review, on an annual basis, our financial records to ensure all related-party transactions are identified, quantified, and adequately disclosed. Also, each director and executive officer must disclose in writing any known related-party transactions during the completion of the annual director and officer questionnaire. Throughout 2022,2023, we employed Dane L. Womble, a brother of 2023-2024 director Dustin R. Womble. Dane L. Womble is the President of our Public Administration Group and received in excess of $120,000 in salary and bonus compensation in 20222023 in exchange for services rendered. He was also granted restricted stock optionsunits with respect to 4,600700 shares of our common stock, which vest over three years, and long-term PSUs with respect to 2,3005,700 shares that are subject to a three-year performance condition. In addition, Dane L. Womble received other employee benefits on the same basis as other, similarly situated employees. Dane L. Womble’s total compensation is consistent with that of similarly situated employees and his compensation terms are established directly with him, independent of any relationship he has with Dustin R. Womble. Throughout 2022,2023, we employed Jennifer M. LeBlanc, a daughter of Executive Chair John S. Marr, Jr. Ms. LeBlanc served as a Senior DirectorVice President of FinanceFinancial Planning and Analysis Management and received in excess of $120,000 in salary and bonus compensation in 20222023 in exchange for services rendered. Ms. LeBlanc was also granted restricted stock units with respect to 7001,100 shares of our common stock, which vest over four years. In addition, Ms. LeBlanc received other employee benefits on the same basis as similarly situated employees. Ms. LeBlanc’s total compensation is consistent with that of similarly situated employees, and her compensation terms are established directly with her, independent of any relationship she has with Mr. Marr. | | | | | | | | | | 42 | | | | | | | | 20232024 Proxy Statement 29

| |

REPORT OF THE AUDIT COMMITTEEReport of the Audit CommitteeThe Audit Committee assists the Board of Directors in fulfilling its responsibilities for general oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements (including but not limited to information security compliance), the independent auditor’s qualifications and independence, the performance of our independent auditors, the effectiveness of our disclosure controls and of our internal controls over financial reporting, and risk assessment and risk management. The Audit Committee manages the relationship with our independent auditors, who report directly to the Audit Committee. The Audit Committee has the authority to obtain advice and assistance from outside legal, accounting, or other advisors as the Audit Committee deems necessary to carry out its duties and to receive appropriate funding from us for such advice and assistance, as determined by the Audit Committee. Management has the primary responsibility for our reporting process, including our systems of internal controls and for preparing our financial statements. In fulfilling its oversight responsibilities, the Audit Committee reviewed with management the audited financial statements contained in the Annual Report, including a detailed discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of the significant judgments, and the clarity of disclosures in the financial statements. The Audit Committee meets with the independent auditors, with and without management present, to discuss the overall scope and plans for the audits and the results of their examinations. The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of the accounting principles and such other matters as are required to be discussed under applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee also reviewed management’s report on internal control over financial reporting and the independent registered public accounting firm’s related opinions. In addition, the Audit Committee received from the independent auditors written disclosures regarding the auditors’ independence required by PCAOB Ethics and Independence Rule 3526, Communications with Audit Committees Concerning Independence, and has discussed with the independent auditors, the independent auditors’ independence. The Audit Committee met five times during 2022.2023. In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board approved) that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2022,2023, for filing with the SEC. This report is submitted by the 2023-2024 Audit Committee. Brenda A. Cline, Chair

Mary L. Landrieu

Daniel M. Pope | | | | | | | | | | 43 | | | | | | | | 30

| | | | | | 20232024 Proxy Statement

| |

CORPORATE GOVERNANCE PRINCPLESCorporate Governance PrinciplesOur Board of Directors has adopted a number of corporate governance policies and practices that apply to the Board, our executive officers, and/or our Company and employee community. Representative highlights of those policies and practices are shared below. For more information, please visit our website, www.tylertech.com.www.tylertech.com. Corporate Governance Guidelines Our Corporate Governance Guidelines include the following: •Independence standards, under which director independence is evaluated on an annual basis under the requirements of applicable rules and standards. •Limitations on the number of additional public company boards on which a director may serve to a maximum of four, and on the number of additional public company audit committees that a member of our Audit Committee may serve to a maximum of two. •Expectations that directors should attend all Board meetings and all committee meetings on which they serve. •Complete and open access to the Company’s executives and senior leadership. •Authority of non-employee directors and each committee to retain independent legal, financial, or other advisors when such advice is necessary, appropriate, and in the best interests of the Company and its shareholders. •Executive sessions of independent directors at least twice annually, and otherwise as deemed necessary and appropriate. •Annual evaluations of directors, committees, and the Board as a whole. •Application of Stock Ownership Guidelines and Stock Anti-Hedging and Pledging Policy to directors and executives. •Annual evaluation of CEO performance against goals and objectives established by the Compensation Committee, in consultation with the Board Chair. •Periodic reports by the Nominating and Governance Committee regarding succession planning. •Prohibition of personal loans by the Company to any director or member of executive management. •Prohibition of stock option repricing. Code of Business Conduct and Ethics Tyler expects all directors, officers and employees to exercise the highest degree of professional business ethics in all actions they undertake on the Company’s behalf. Our Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all of our directors, executive officers (including, without limitation, the chief executive officer, chief financial officer, principal accounting officer, and controller), and employees. The policies established under the Code include: •Steps for contacting the Chair of the Audit Committee to report any concerns about an accounting, auditing, internal control, or related matter, and prohibition of retaliation for reporting the same. •Expectations to conduct all Company business in accordance with applicable law. •Prohibition of the use of any Company asset for any unlawful or improper purpose. •Prohibition of any Company political contribution to any political party, committee, or candidate for public office, as well as on payments to government officials and personnel. •Prohibition of financial or other interests that might conflict with the best interests of the Company.

| | | | | | | | | | Corporate Governance Principles | | |

•Requirement to use reasonable care to protect against the unauthorized use or disclosure of the Company’s confidential or proprietary information. •Prohibition of insider trading and imposition of trading limitations that apply to all directors, officers, and employees during applicable timeframes. •Encouraging employees to report any work-related accident or injuries, or unsafe or hazardous working conditions, and prohibition of retaliation for reporting the same. •Commitment to equal employment and non-discrimination, encouraging a diversity of backgrounds, cultures, experiences, insights and skills in the Company’s workforce. •Prohibition of all forms of harassment, with reporting instructions in the event of an incident and prohibition of retaliation for reporting the same. The Board periodically reviews the Code and any adopted updates are posted to our website. Company employees must review and acknowledge the Employee Handbook, which incorporates the Code, on an annual basis, and receive regular training on Code topics such as protecting confidential information and anti-harassment. We also publish regular reminders about Tyler’s insider trading policy, trading limitations, and whistleblower policy. | | | | | | | | | | 2023 Proxy Statement 31

| |

TABLE OF CONTENTS

In 2021, our Board of Directors adopted a standalone anti-bribery policy, setting forth our expectations of integrity and anti-bribery specific to Tyler’s foreign activities and international presence, consistent with the applicable provisions of the U.S. Foreign Corrupt Practices Act and other international anti-bribery laws that prohibit unlawful payments to secure unfair business advantages. The policy applies to the Company and all of its subsidiaries and each of their directors, officers, employees, agents and representatives. Potential or suspected violations are to be reported to a member of the Audit Committee or to our Chief Legal Officer. Whistleblower Policy Tyler is committed to compliance with all applicable securities laws and regulations, accounting standards, accounting controls, and audit practices. The Board of Directors adopted a standalone Whistleblower Policy.Policy, which is posted on our website and referenced in other Company documentation. That policy sets forth detailed procedures for the reporting of concerns or complaints regarding accounting, internal accounting controls, or auditing matters, including concerns around questionable accounting or auditing matters. Tyler does not permit retaliation of any kind for reporting a concern or complaint under the policy. Stock Ownership Guidelines In 2018, our Board of Directors approved stock ownership guidelines, which were updated in 2022 to increase the ownership requirement applicable to directors. The guidelines are based on the Board’s belief that Tyler’s directors and executive officers should have a meaningful ownership stake in Tyler that will align their interests with Tyler’s shareholders and will promote sound corporate governance. The guidelines apply to non-employee members of the Board and designated executive officers of Tyler. The market value of shares each “covered person” is required to hold is equal to or greater than the ownership levels specified below, based on a multiple of executive officers’ base salary or non-employee directors’ annual cash retainer. | | | | | |

| Covered Person Position | | | Stock Ownership Guideline | | | | | Executive Chair, Chief Executive Officer, President | | | 6 times base salary | | | Other Named Executive Officers | | | 4 times base salary | | | Other Executive Officers as designated by the Compensation Committee of the Board | | | 1 times base salary | | | Non-employee Directors | | | 5 times annual cash retainer |

| | | | | | | | | | Corporate Governance Principles | | |

Compliance is evaluated once a year, as of the last day of each fiscal year. We expect each covered person to meet these guidelines within three years from their commencement of service with Tyler as a covered person. In the event of a promotion or an increase in base salary, annual cash retainer, or ownership requirement, the covered person is expected to meet the higher ownership amount within three years from the effective date of the promotion, salary, retainer change, or ownership requirement. Each of our covered persons is in compliance with the stock ownership guidelines as of December 31, 2022.2023. A copy of the Stock Ownership Guidelines may be found on our website, www.tylertech.com.www.tylertech.com. Insider Trading Policy Our insider trading policy (most recently adopted by the Board in 2018)2023) prohibits our directors, officers, and employees (as well as family members and others living in a covered person’s household), from engaging in transactions in Tyler stock while in the possession of material non-public information, from disclosing material non-public information to unauthorized persons outside Tyler, and from “short selling” Tyler stock (or an interest in Tyler stock). The policy additionally includes a general blackout period for stock transactions beginning on the first business dateday after the end of each fiscal quarter through the close of trading on the second full business day after Tyler’s public earnings announcement. Directors, executive officers and executive management, and officers or key employees of any Tyler division (including accounting personnel) may not buy or sell Tyler stock without prior approval from our Chief Legal Officer. These persons are also subject to an extended blackout period that begins on the 16th day of the third month of each fiscal quarter through the close of trading on the second full business day after our public earnings announcement. A copy of the Insider Trading and Confidentiality Policy may be found on our website, www.tylertech.com. | | | | | | | | | | 32

| | | | | | 2023 Proxy Statement

| |

TABLE OF CONTENTS

Rule 10b5-1 Plans No director or officer of Tyler has a Rule 10b5-1 trading plan or a non-Rule 10b5-1 trading arrangement in place as of April 6, 2023,March 29, 2024, or had one in place during 2022.2023. Stock Anti-Hedging and Pledging Policy Also inIn 2018, our Board approved an anti-hedging/pledging policy, which provides that the same non-employee directors and executive officers subject to the Stock Ownership Guidelines are prohibited from engaging in any hedging transaction that could reduce or limit that person’s holdings, ownership or interest in Company securities. Such transactions, while allowing the holder to own Tyler’s securities without the full risks and rewards of ownership, potentially separate the holder’s interests from those of our shareholders generally. In addition, those same covered persons are discouraged from pledging Company securities or from holding our securities in margin accounts and are prohibited from doing so to the extent of the Stock Ownership Guidelines. A copy of the Stock Anti-Hedging and Pledging Policy may be found on our website, www.tylertech.com.www.tylertech.com.

| | | | | | | | | | Corporate Governance Principles | | |

Corporate Responsibility WhileWe recognize the importance of corporate responsibility and take a thoughtful approach to our sustainability and governance programs, practices, and policies to maximize the benefit to Tyler, our stakeholders and the communities we impact. The Board is regularly briefed on Tyler’s environmental, social, and governance (ESG) initiatives, and the Nominating and Governance Committee has beenis tasked with direct oversight responsibility for those activities. Tyler’s ESG disclosures are designed to align withinfluenced by recognized frameworks including the Sustainability Accounting Standards Board Standards and the Global Reporting Initiative Standards. We also support actions of theall 17 United Nations Sustainable Development Goals (UN SDGs) and believe our efforts best align withbusiness can generate the most impact on SDG 9 (Industry, Innovation and Infrastructure), SDG 11 (Sustainable Cities and Communities), and SDG 16 (Peace, Justice and Strong Institutions). In 2022,2023, Tyler placed in the 96th95th percentile of companies in the Software and Diversified IT Services industry in the S&P Global Corporate Sustainability Assessment,Assessment.

During 2023, Tyler transformed its corporate responsibility reporting by implementing a data management and we were included in the Dow Jones Sustainability Index for the second consecutive year. We also continuevalidation platform designed to be recognized in the top 20% of sustainability performers among the 600 largest U.S.further refine our processes and Canadian companies in the S&P Global Broad Market Index. controls. Tyler’s cross-functional management committee (including executive leaders from Tyler’s finance, human resources, and legal disciplines) met regularly throughout 20222023 to continue the coordination and communication of our ESG initiatives.initiatives, among other things. More information can be found in our Corporate Responsibility Reports, which we make available on our website, www.tylertech.com/about-us/who-we-are/corporate-responsibility.corporate-responsibility. Since 2021, those reports have also included EEO-1 data. While we encourage shareholders to review the Corporate Responsibility Reports we make available, we are pleased to share some ESGthe following corporate responsibility highlights from 2022.2023: •We launched “Green Teams,” which are self-organized, cross-functional groupsconducted a Double Materiality Assessment to identify and prioritize the relevance of sustainability matters to our financial materiality and impact materiality •We invested in energy efficiency and water diversion projects at various Tyler team members who voluntarily come togetheroffices and upgraded our solar generation monitoring software at our headquarters in Plano, Texas. •We expanded the breadth of Scope 3 emissions accounting for our GHG inventory. •We continued to educate co-workers on sustainability practices. Guided by our “Better Together, with Flexibility,” principles, we supported work arrangements that balance collaborative in-person work environments with remote-work options to accommodate team member needs.

We strengthenedstrengthen our Diversity, Equity, and Inclusion (DEI) initiativesefforts by establishing a Corporateenhancing our DEI Council, which brings togethergovernance structure and executive leadership from local DEI councils andsupport for Employee Resource Groups to collaboratefoster continued collaboration and leverage DEI bestinclusion practices across Tyler.

•We continuedhonored our annualTyler military veterans by presenting them with challenge coins that represent not only their sacrifice and commitment to our country, but also their dedication to Tyler’s mission of empowering the public sector to create smarter, safer, and stronger communities. •We redesigned our anti-harassment training on topics such as anti-harassment, dataand achieved a nearly 100% completion rate. We also achieved a 93.7% completion rate for our security and data privacy training, and grew our expectations for ethical team member conduct.Security Champions program. Our shareholders approved three shareholder rights amendments to our corporate charter, as discussed in detail in the 2022 Proxy Statement.

We promoted a Tyler leader to the role of Chief Information Security Officer, reporting directly to our Chief Operating Officer.

•We provided quarterly briefings to the Board and the Audit Committee on information security matters, with as-needed interim updates to the Audit Committee in its oversight capacity for information security matters. • | We continued to operationalize the privacy practices outlined in•We updated our Insider Trading Policy and our Privacy Statement, each of which is publicly available on our website, www.tylertech.com. |

| | | | | | | | | | 47 | | | | | | | | 20232024 Proxy Statement 33

| |

TABLE OF CONTENTS

Tyler is committed to regular, proactive and responsive engagement with our shareholders and prospective investors, as we believe these are constructive conversations that build better understanding of stakeholder perspectives and support strong corporate governance. Over the course of 2022,2023, Tyler leadership and members of our Board of Directors regularly engaged with shareholders. Those engagementsshareholders on topics predominantly centered on our approach to enterprise risk management, board composition considerations, compensation practices, human capital development, talent recruitment, and overall progress on ESGour corporate responsibility matters. The Chairs of our Compensation Committee and Nominating and Governance Committee were typically joined by our Chief Financial Officer, Chief Legal Officer, andand/or Chief Human Resources Officer for those discussions. We also regularly welcomed investors and prospective investors at our corporate headquarters, where they typically met with our Chief Executive Officer, Chief Financial Officer, and/or Chief Operating Officer, along with other Company leaders. Specific to compensation practices, our discussions focused on current levels of compensation and performance metrics used in providing short-term and long-term incentive compensation to our Named Executive Officers. At our 20222023 Annual Meeting of Shareholders, our say-on-pay proposal received the support of 94%over 97% of the votes cast. Our Board views this support as affirmation that our shareholders support our approach to Named Executive Officer compensation, that our policies are in alignment with our shareholders, and that they appropriately reflect our “pay for performance” philosophy. Based on engagement with shareholders and the high level of approval, the Compensation Committee determined that current executive compensation practices and those being considered for the future remain appropriate. The governance practices we discussed with investors included our thoughtful approach to Board composition, including the skill sets each director brings to the Board and Board diversity,how those are intended to complement the Company’s strategic priorities. We also responded to shareholder inquiries regarding talent retention and development, allocation of risk management, and our effortsperformance against various sustainability metrics. We believe these conversations were fruitful, and reflected a shared understanding of the Company’s commitment to balance diversity “targets”sound governance practices that inherently align with the successful integration of two Board members whose onboarding was impacted by the COVID-19 pandemic. We also regularly discussed our climate strategies and the inherent climate-friendly naturebusiness philosophy. Another element of our software solutions that replace paper-based systems. We received positive feedbackopen dialogue with shareholders is their input on the perspectivesour long-term business strategy and our overall sustainability practices. For example, in June 2023, we shared,hosted an investor day where we welcomed 40 in-person attendees and were gratified that those conversations reflected an understandingnearly 215 participants who attended via livestream. The event featured presentations by our senior executives and members of our philosophies.division leadership who discussed Tyler’s plans for its cloud transition and its strategic growth roadmap, including our mid- to long-term financial targets and capital allocation framework, all supporting what we refer to as our 2030 vision. Later in 2023, we conducted a Double Materiality Assessment through a robust internal and external stakeholder engagement effort to assess and rank the relevance of 26 ESG topics that we identified based on our business priorities and industry research. Over 150 stakeholders participated in the process, including our executive leadership, members of our Board of Directors, team members, shareholders, clients, suppliers, and business partners. Through surveys and interviews, we solicited valuable feedback and unique perspectives on potential ESG risks and opportunities for our organization, helping us to holistically prioritize material topics for our Company and to refine our corporate responsibility strategy. | | | | | | | | | | 48 | | | | | | | | 34

| | | | | | 20232024 Proxy Statement

| |

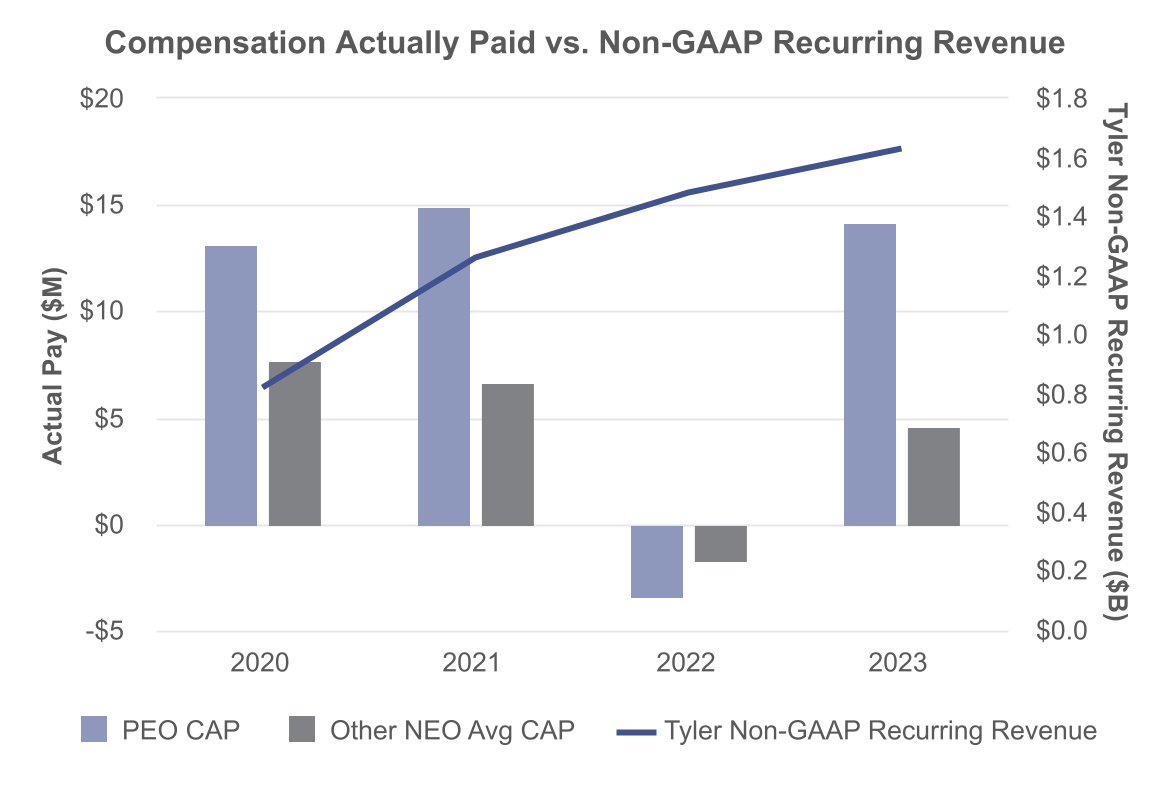

COMPENSATION DISCUSSION AND ANALYSISCompensation Discussion and AnalysisThis Compensation Discussion and Analysis describes the compensation program for certain of our executive officers (the “Named Executive Officers” or “NEOs”) and provides an overview of our executive compensation philosophy, objectives, policies and practices. It also describes how and why the Compensation Committee made specific decisions relative to Named Executive Officer compensation, including the objectives and key factors considered in determining 20222023 compensation, and summarizes 20232024 approved compensation. 2023 Business Highlights In 2022,2023, we experienced positive trends in public sector market activity, as proposalachieved our key objectives for the year and other sales activities reachedboth earnings and evencash flow surpassed pre-COVID levels. For the full year, bookings were up 9.5 percent. In addition, we completed three acquisitions andour expectations. We continued to accelerate our move towards becomingto a cloud-first organization.organization with increased cloud adoption from both new and existing clients. SaaS revenues grew 23.2% and comprised approximately 85% of the total new software contract value, compared to approximately 83% in 2022. In terms of financial performance,addition, we achievedcompleted four strategic acquisitions: Computing System Innovations (CSI), Safeground Analytics, ResourceX, and ARInspect. These new offerings and the following:team members who support them help us expand AI capabilities across our product portfolios, bring enhanced functionality to our clients, and incorporate deep domain expertise. For the year ended December 31, 2022:2023: •Total revenues were $1.952 billion, up 5.5% over 2022. On an organic basis (excluding COVID-related revenues in 2022), revenues grew 7.4%. •Recurring revenues were $1.63 billion, up 9.8%, and comprised 83.3% of 2023 revenues, up from 80.0%. On an organic basis, recurring revenues were $1.61 billion, up 9.5%. •We achieved annualnet income under Generally Accepted Accounting Principles (“GAAP”) revenue of $1.850 billion, a 16.2 percent increase over 2021; Recurring revenues increased 17.6 percent over 2021 to $1.481 billion, and comprised approximately 80 percent of our total revenues in 2022;

GAAP earnings$165.9 million, or $3.88 per diluted share, increased 1.7 percent to $3.87 in 2022, and non-GAAP earningsup 1.0%. Non-GAAP net income was $333.7 million, or $7.80 per diluted share, increased 7.3 percent to $7.50;up 4.9%.

•We generated $381.5$380.4 million in cash provided byfrom operations during the year and ended the year with total cash and investments of $229.4$182.9 million, and $995 million in debt;total outstanding debt, including convertible debt, of $650 million. •We continued to strengthenfurther strengthened our balance sheet repaying $360 million ofand reduced term debt and ending the year withby $345 million, bringing our net leverage at year-end to under one times pro forma EBITDA. We have repaid $1.1 billion of approximately 1.64 times proforma EBITDA;debt since the acquisition of NIC in April 2021. We generated Adjusted EBITDA of $475.0 million;Our mix of new business continued to shift to the cloud, with SaaS agreements comprising 83% of our new software contract value, up from 71% in 2021; and

We closed the year with backlog of $1.889 billion, up 5.2 percent from 2021.Our executive officers, along with our entire team, were focused on leading our business and clients to emerge from the impact of COVID-19 and deliver on strategic objectives and key operational initiatives in 2022. In addition to our financial performance, 20222023 achievements included:

• | Recognition for the 6th consecutive year by Government Technology (GovTech) on its “2022 GovTech Top 100” list and recognition for the 2nd consecutive year as a top sustainability performer in the Dow Jones Sustainability Index (DJSI) North America.

|

•A successful Investor Day in June 2023, where we unveiled our Tyler 2030 plan for driving growth and margin expansion over the remainder of the decade. •Recognition for the 7th consecutive year by Government Technology Magazine on its “2023 GovTech 100” list. •The increased return of Tyler team members to our more than 60 office locations with enhanced flexible work options. •Celebration of an important milestone in Tyler’s history – 25 years of empowering the public sector market. •Our largest-ever Tyler Connect user conference in San Antonio, Texas. •The successful launchopening of our brand evolution initiative, which streamlined our brand architecturenewly renovated and application names.expanded office in Manila, Philippines The return•Implementation of in-person Connect user conferences — this year in Indianapolis, Indiana — after moving to a virtual format in 2020 due to the pandemic.

The rollout of myTyler, our new global HR platform, which brings all Tyler team members together within one systemenhanced financial and set of employee tools.

The completion of three strategic acquisitions: US eDirect, Quatred, and Rapid Financial Solutions.

The creation of a new chief information security officer role, to further safeguard Tyler’s data, applications,tools and systems.

| | | | | | |

| | | 2023 Proxy Statement 35 | |

TABLE OF CONTENTS

2022 Executive Compensation Summary Named Executive Officer compensation was reviewed by the Compensation Committee in multiple meetings givenleading into and during 2023. The Committee focused on aligning NEO compensation with Tyler’s 2030 vision and reflecting peer data, shareholder engagement, and the previously communicated planadjustments to endour NEO employment agreements we recently undertook. With these factors in mind, the historic practiceCommittee eliminated the use of options, replacing the majority of NEO equity compensation with performance-based restricted stock units (“PSUs”) and providing for the limited use of restricted stock units (“RSUs”). In so doing, the Committee achieved a material portionbalance of 80% performance-based and 20% service-based compensation to the Named Executive Officer compensation in the form of equity grants every five years. The Committee reviewed compensation provided to each Named Executive Officer, with and without the annual value of the equity compensation associated with the five-year grant, and relative to multiple factors including company and individual performance, executive retention, and multiple peer groups as described later in this discussion and analysis.Officers. As a result, of this review, 20222023 compensation to our Named Executive Officers was approved as follows: •Mr. Marr and Mr. Puckett received no increase to theirhis annual salariessalary in 2022.2023. The annual salaries of Mr. Moore, Mr. Miller, and Mr. MillerPuckett were increased by 14.3%12.5%, 2.4%, and 3.8%8.3%, respectively. The salaries for •As Executive Chair, Mr. Moore and Mr. Miller were last increased in February 2020. Marr does not receive a short-term incentive. No changes were made to short-term incentive target levels of Mr. Moore or Mr. Miller. As Executive Chair, Mr. Marr does not receive a short-term incentive.Miller for 2023. Mr. Puckett’s short-term incentive target was increased from 75%85% to 85% of annual salary consistent with100% to reflect the final stage in his expanded role as COO.transition to Chief Operations Officer. Mr. Moore, Mr. Miller, and Mr. Puckett earned 2,054; 1,421;1,930 ; 1,215; and 873929 short-term performance-based restricted stock units (“PSUs”),PSUs, respectively, reflecting 110%representing 125% of the target amounts based on achievement of short-term incentive performance goals in 2022.2023. •With the transition from options to PSUs in 2023, Mr. Marr received 7,500 stock options in 2022, which was unchanged from 2021. Mr. Marr did not receivegranted 2,810 PSUs in his role as Executive Chair in 2022. Stock options granted toChair. Mr. Marr did not receive RSUs. Mr. Moore, were increased from 18,000 in 2021 to 20,000 in 2022, and the number of PSUs granted to Mr. Moore increased from 5,000 to 6,500. Stock options granted to Mr. Miller, were reduced from 12,000 in 2021 to 10,000 in 2022 and the number of PSUs granted to Mr. Miller increased from 3,333 to 3,750. Stock options granted to Mr. Puckett were increased from 4,700granted 20,306; 9,542; and 5,934 PSUs, respectively, and 3,124; 1,390; and 781 RSUs, respectively, in 2021 to 6,500 in 2022 and the number of2023. The PSUs granted in 2023 will vest in 2026 based on achievement of three-year performance goals. The RSUs granted will vest one-third each year over three years from grant date. •In 2023, the Committee approved vesting of 6,000; 3,999; and 2,400 PSUs granted as part of the 2020 long-term incentive grant to Mr Moore, Mr. Miller and Mr. Puckett, increased from 2,350 to 2,500.respectively, reflecting 150% of the target amounts based on achievement of long-term incentive performance goals set in 2020.

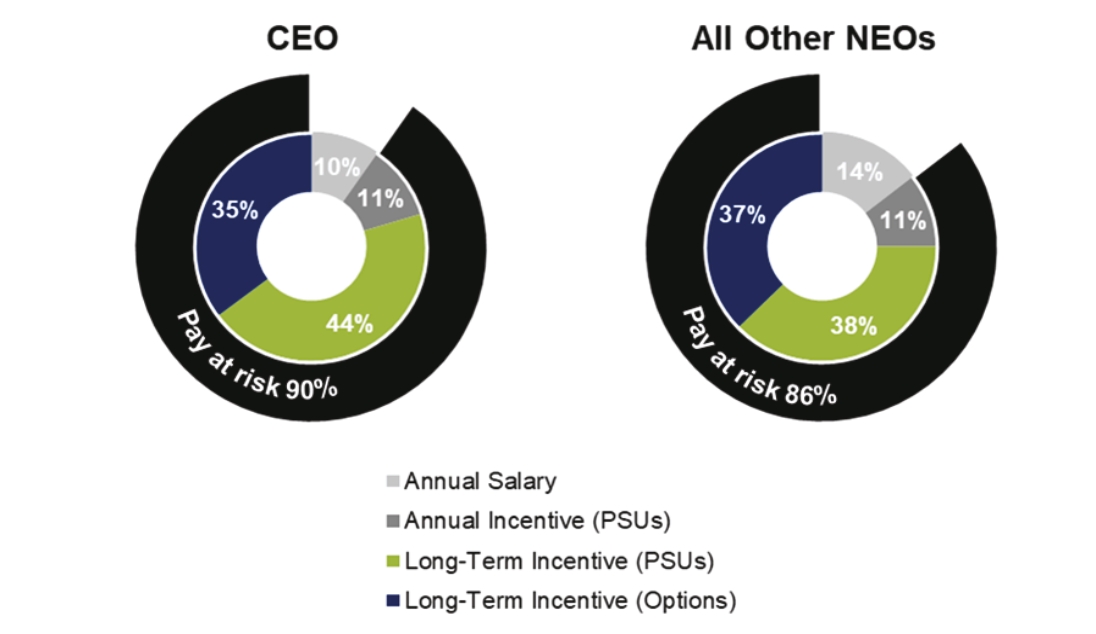

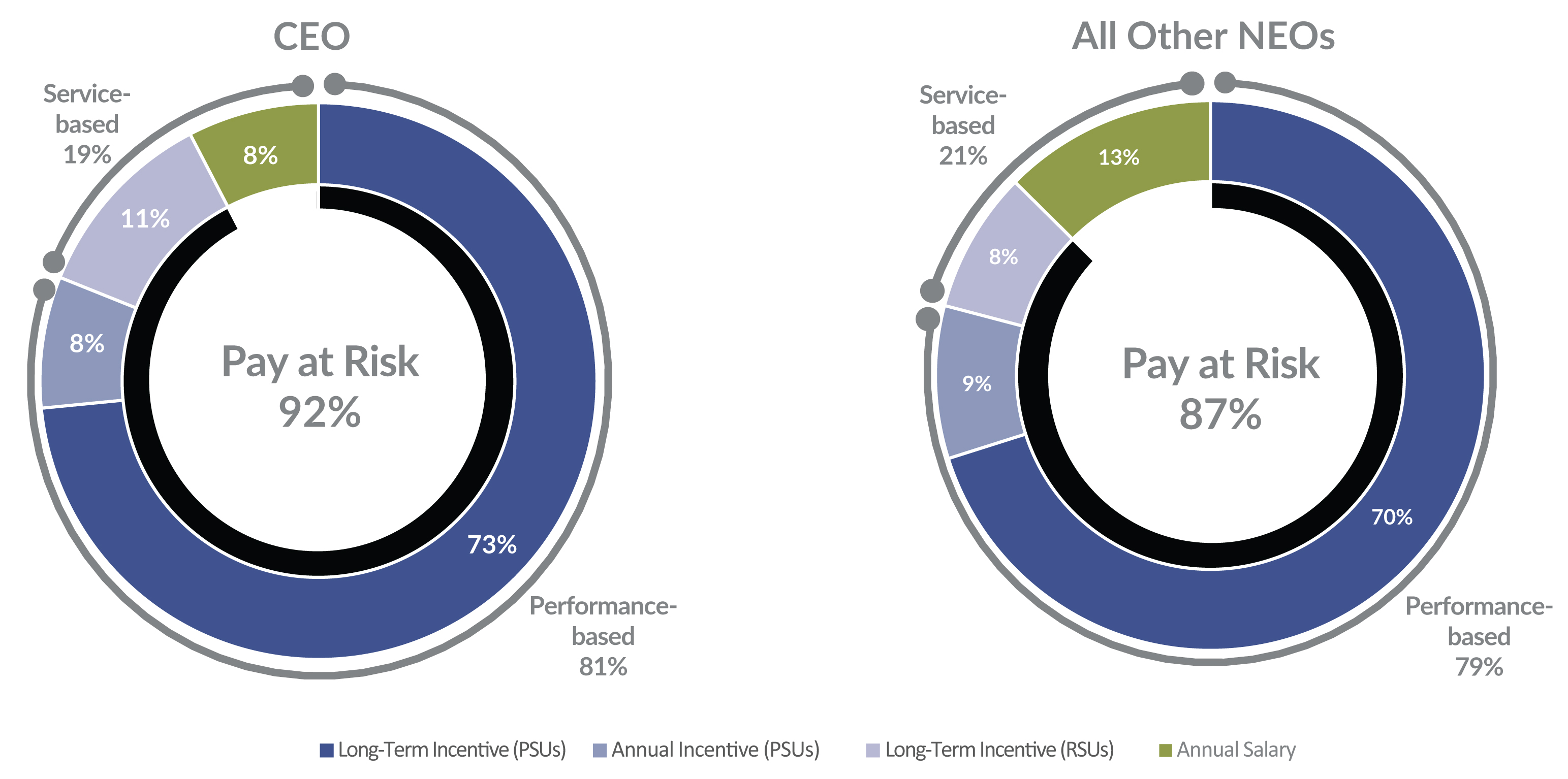

The total direct compensation received by our Named Executive Officers in 20222023 was allocated as follows: Our executive compensation program emphasizes performance-based compensation tied to the creation of long-term shareholder value. We believe incentives that vest over multiple years motivate and retain our executives while aligning their interest in the long-term performance of the Company with that of our shareholders. As a result, in 20222023 a substantial portion of our executives’NEO compensation consisted of performance-based restricted stock units and stock options that provide no value to our executivesNEOs unless value is created for our shareholders through long-term performance of the Company. | | | | | | | | | | 51 | | | | | | | | 36

| | | | | | 20232024 Proxy Statement

| |

TABLE OF CONTENTS

COMPENSATION PHILOSOPHY AND OBJECTIVESCompensation Philosophy and Objectives Elements of Executive Compensation We believe that sustained achievement of measurable financial objectives leads to increased shareholder value. As such, a significant portion of our Named Executive Officers’ target total direct compensation is “at-risk” and based on the achievement of annual and long-term financial objectives. Linking our NEO compensation to challenging performance objectives creates a strong incentive to achieve both short-term growth and profitability objectives and to create sustainable long-term value for our shareholders. | | | | | | | | | | | | | | | | | | | | | | | | | Element | | Element

| | Form of

Compensation | | Purpose | | Purpose

| | | 20222023 Metric

| | | | | | | | | | | | | | | | | | Base salaryService-Based

Compensation Generally 20% of Total Target Compensation | Base Salary | | Cash | | Cash

| | ProvideProvides competitive, fixed compensation to attract and retain executive talent with the specific skills and experience needed to drive continued growth

| | | Base salary is a fixed component and changes to salary, when made, are dependent on individual performance, peer and market comparisons and retention goals | | | | | | | | | | Annual Stock Grant | | Restricted stock units (RSUs) | | Supports retention and provides competitive annual compensation level to attract and retain executive talent | | Provided as needed to maintain target ratio of service-based compensation (salary + RSUs) and approved by the Committee | | | | | | | | | Performance-Based Compensation Generally 80% of Total Target Compensation | Annual Incentive compensationCompensation | | | Performance-based restricted stock units (PSUs) | | | Provides reward for achieving or exceeding annual financial performance goals | | | Achievement of adjusted earnings per share goals (Non-GAAP), which are recommended by the CEO and approved by the Compensation Committee | | | | | | | | | | Long-term incentive compensation | Long-term equity-based compensation

| | | Performance- based restricted stock units (PSUs) and stock options | | | Create a strong financial incentive for shareholder value creation with significant Company equity stake linked to long-term, future Company performance | | | Achievement of 3-year Cumulative Recurring Revenue Growth, (PSUs); shareholder value created, inas recommended by the formCEO and approved by the Compensation Committee | | | | Performance- based restricted stock units (PSUs) | Achievement of increased value per share (options) | 2025 Operating Margin, as recommended by the CEO and approved by the Compensation Committee |

| | | | | | | | | | 52 | | | | | | | | 20232024 Proxy Statement 37

| |

Executive Compensation Related Policies and Practices We operate under the following compensation-related governance practices for responsible management of risk and expense in the reward of our Named Executive Officers: | | | | | | | | |

| Our Philosophy | | | Our Practice | | | | |

| | | | Our executive compensation program and practices are designed to reward for performance, not provide perquisites | | | Total Target Compensation for our Named Executive Officers is consistently set at or below levels within our peer group with the opportunity for increased compensation based on performance above planned growth goals. | | | | | | 88%80% or more of total target compensation to our Named Executive Officers is “at risk” compensation.

| performance-based compensation and between 85% and 90% of total target compensation is equity based and ‘at risk’. | | | | | Our Named Executive Officers receive no material non-cash benefits, deferred compensation benefits, or other executive perquisites. | | | | | | Our Named Executive Officers participate in the same health and welfare benefits available to all employees of the Company and on the same terms as are broadly available. | | | | |

| We deliver pay for performance that consistently meets or exceeds expectations | | | Performance-based incentives are provided upon the achievement of annual growth and operational goals and long-term growth goals that increase shareholder value. The potential for additional compensation is linked to performance levels that exceed Board of Directors and shareholder expectations for performance and growth. | | | | |

| We administer our executive compensation programs and practices responsibly on behalf of our shareholders | | | Our Compensation Committee is comprised solely of independent directors. | | | | | | We maintain an executive compensation recovery policy and incentive compensation recovery policy as described further in the “Other Important Elements of our Executive Compensation” section. | | | | | | We maintain stock ownership guidelines, referenced in more detail in the “Stock Ownership Guidelines” section, which require our executives to hold a meaningful ownership stake in the Company. | | | | | | We design and administer our executive compensation program with caps and appropriate controls to ensure excessive risk taking is not incentivized as described in the “Other Important Elements of our Executive Compensation” section. | | | | | | Our 2018 Stock Incentive Plan does not permit stock option exchanges or repricing without shareholder approval. | | | | | | We maintain a Stock Anti-Hedging and Pledging Policy, described in the “Stock Anti-Hedging and Pledging Policy” section, to prohibit our executives from engaging in transactions that could reduce or limit their holdings, ownership or interest in Company securities and to discourage our executives from pledging Company securities or from holding Company securities in margin accounts. | | | | | | Since 2017, we have conducted an annual shareholder advisory vote on Named Executive Officer compensation and maintain ongoing outreach to our investors to understand their perspectives on our executive compensation program. | | | | | | Our Compensation Committee conducts an annual self-assessment. | | | | | | We do not provide excise tax payments or “gross ups” on future post-employment compensation to our Named Executive Officers if they become eligible for severance payments under the terms of their employment agreements. | |

| | | | | | | | | | 53 | | | | | | | | 38

| | | | | | 20232024 Proxy Statement

| |

PROCESS FOR SETTING EXECUTIVE COMPENSATIONProcess for Setting Executive CompensationThe Compensation Committee carries out the responsibilities of our Board relating to the compensation of our Named Executive Officers, with input from all of our independent directors including:directors. The Committee’s responsibilities include: •Reviewing and approving all compensation of our CEO and other Named Executive Officers; •Reviewing and approving performance goals used in the design of our annual and long-term incentive plans; •Reviewing and approving CEO and other Named Executive Officer post-employment compensation arrangements; and •Reviewing and approving this Compensation Discussion and Analysis. The Compensation Committee carries out these duties in the interests of our shareholders based on our compensation philosophy and objectives. The Committee’s focus is on developing and maintaining an executive compensation program that is competitive and balances the need to attract, motivate, and retain a talented, experienced executive team within a context of responsible cost and risk management. In the course of carrying out theirits duties, the Compensation Committee consults with our Human Resources, Finance,human resources, finance, and Legallegal departments to gather information regarding corporate and individual performance,performance; peer and market comparator data,data; regulatory changes; and relevant financial, legal, and legalESG best practices, and regulatory changes.among other things. The Compensation Committee reviews recommendations for performance measures and related target levels of pay for our Named Executive Officers, which are prepared by our Chief Human Resources Officer and presented in the context of our operational and long-term performance objectives, our compensation philosophy and objectives, and peer compensation data. Role of Our CEO and the Other Named Executive Officers Our Named Executive Officers do not make recommendations regarding their own compensation. The Compensation Committee does solicit the opinions of our Executive Board Chair and our Chief Executive Officer relative to the level of attainability and risk associated with performance objectives in the performance-based compensation elements and to the rationale for any individual changes to Named Executive Officer compensation (other than their own). The Compensation Committee reviews and discusses the recommendations presented and uses them as one factor in approving the compensation of our Named Executive Officers.

| | | | | | | | | | Process for Setting Executive Compensation | | Table of Contents |

Factors Considered in Setting Executive Compensation In determining the amount and form of the compensation elements, the Compensation Committee considers a number of factors, including: Our executive compensation program objectives;

Corporate•Operational and long-term growth goals and performance against these goals as reflected in the achievement of key strategic, financial and operational objectives;

Responsible•Our executive compensation program objectives, including responsible compensation pay practices and mix of pay elements which minimize excessive risk taking;

Base•Annual salaries, annual incentives, and long-term incentives provided in our peer group and for peer roles in the Radford Global Technology Survey;

•Performance and retention of the Named Executive Officers and the value of that retention to shareholders; and •Feedback and perspectives gained from engagement with shareholders. Each year, our Chief Human Resources Officer provides the Compensation Committee with data to support a review of the market competitiveness of our executive compensation relative to broad industry peers, which is described in detail below. In addition to a review of this information, the Compensation Committee considers the overall objectives of our executive compensation program and the elements of the program, including the mix of cash and stock-based compensation, and the mix of short-term and long-term compensation, and the mix of performance-based and service-based compensation, to determine whether they are appropriate relative to operational objectives and long-term performance of the Company. The Compensation Committee may retain the services of compensation advisors for the purposes of assisting in the determination of executive compensation. In 2022,2023, the Compensation Committee engageddid not engage a consultant, from Pearl Meyer to review and discuss with our Compensation Committee materials prepared by the Chief Human Resources Officer for Committee review.instead relying on guidance provided in previous engagements. Our Named Executive Officers’ compensation is primarily composed of base salary, bonus, PSU grants, and stock option and PSURSU grants, and does not include more complex elements such as deferred compensation plans. Beginning in 2023, our Named Executive Officers’ compensation currently does not include option grants. Peer Group In order to provide the Compensation Committee with more detailed and specific information about executive compensation levels and practices, we utilize a peer group (the “Peer Group”) each year to assist in determining appropriate compensation levels for the Named Executive Officers. The Peer Group used for competitive analysis consists of publicly traded companies of similar size to Tyler, most of which are in the enterprise software space. | | | | | | | | | | 2023 Proxy Statement 39

| |

TABLE OF CONTENTS

The 1513 companies in the Peer Group used to assist in setting 20222023 compensation were: | | | | | |

| ACI Worldwide, Inc. | | | Pegasystems, Inc. | | | Ansys, Inc. | | | PTC, Inc. | | | Blackbaud, Inc. | | | RingCentral, Inc. | | | Envestnet, Inc.

| | | Splunk | | | Fair Isaac Corporation | | | Veeva Systems, Inc. | | | Fortinet, Inc.

| | | Zendesk, Inc.

| | | Hubspot, Inc. | | | Ziff Davis, Inc. | | | Jack Henry & Associates, Inc.

| |

| | | | | | | | | | 55 | |

| 2024 Proxy Statement |

| | | | | | | | | | Process for Setting Executive Compensation | | Table of Contents |

We review the Peer Group annually to ensure that the companies in the Peer Group remain relevant and provide meaningful compensation comparisons. In January 2022,February 2023, the Compensation Committee reviewed the final Peer Group relative to Tyler considering multiple factors, including the following four key metrics: revenue; market capitalization; and one-year and three-year total shareholder return. The Compensation Committee determined the Peer Group was appropriate as proposed for 20222023 executive compensation comparativecomparison purposes. The table below shows a comparison of those key metrics for Tyler in 2022 to the peer group average:average for those key metrics: | | Tyler Technologies, Inc. | | | $1,117 | | | $17,604 | | | 45.5% | | | 35.1% | | | | Peer Group Average | | | $1,419 | | | $16,917 | | | 43.7% | | | 35.9% | |

| | | | | | | | | | | | | | | | | | | Revenue | Market Capitalization | TSR(1y)

(%) | TSR(3y)

(%) | | | (in millions) ($) | | | | | | | | | Tyler Technologies, Inc. | 1,592 | | 22,043 | | 23.2 | | 42.5 | | | | Peer Group Average | 1,587 | | 15,615 | | 1.0 | | 24.0 | | |

In addition to Peer Group data, and data from those peers identified by ISS and Glass Lewis, the Compensation Committee reviews compensation data for each of the Named Executive Officer’s roles from the Radford Global Technology Survey (the “Radford Survey”), which it has used since 2010. Over 2,000 technology and life science companies use the Radford Survey to benchmark their compensation practices for all levels within their organizations. This data is provided to the Compensation Committee by the Chief Human Resources Officer. The Compensation Committee uses Peer Group and survey data as a reasonableness check. This flexibility is important in designing compensation arrangements which attract and retain new executives in the highly competitive and rapidly changing environment in which we compete for growth and talent. Positioning of Pay The Compensation Committee determines target total compensation for our Named Executive Officers after considering analysis of the Peer Group and Radford Survey data. The Committee does not apply a formula that ties our total compensation levels to specific market percentiles. The Committee does apply a general practice of setting target compensation at a target pay mix of 20% service-based compensation and 80% performance-based compensation. For the purposes of these targets, service-based compensation includes annual salary and the value of any restricted stock units at grant. Performance-based compensation includes the target value of the short-term stock incentive award and the long-term stock incentive award at grant; all of which require achievement of financial goals to be earned by the Named Executive Officers. | | | | | | | | | | 56 | | | | | | | | 40

| | | | | | 20232024 Proxy Statement

| |

TABLE OF CONTENTS

ANALYSIS OF NAMED EXECUTIVE OFFICER COMPENSATION2022 Analysis of Named Executive Officer Compensation2023Named Executive Compensation Structure and Process In January 2022, the Committee conducted in-depth analysis of Named Executive Officer compensation as part of our multi-year business strategy and long-term growth goals, as well as the plan, previously communicated to shareholders in 2019, to eliminate the historic practice of granting equity associated with the legacy five-year employment agreements. With the final vesting of equity associated with the previous five-year grants set to occur in 2023, the Committee’s goal was to ensure that NEO compensation design and levels moving forward reward appropriately for the achievement of operational and long-term growth goals and align with governance best practices. The Committee conducted this work with the expectation that its decisions regarding 2023 NEO compensation would reflect our approach to NEO compensation moving forward, including: •Use of a total compensation target mix, generally 20% service-based and 80% performance-based, consistent with peer and governance best practices to avoid incentivizing excessive risk taking; •Introduction of RSUs, which vary by executive, to supplement annual salary in reaching the 20% service-based level of target total compensation; •Elimination of stock options as a form of equity compensation, at the present time, based on shareholder outreach, governance best practices, and peer group analysis; and •Increased PSUs to provide focus and reward for achievement of key long-term goals, and to supplement target annual incentives in reaching the 80% performance-based level of target total compensation. In February 2023, the Compensation Committee approvedreviewed the total 2022final proposed executive compensation packagesprogram and individual compensation elements for Mr. Marr, Mr. Moore, Mr. Miller, and Mr. Puckett, who was added aseach of the Named Executive Officers, including our Chief Executive Officer, in May 2021.as described below. The totalCommittee considered the overall objectives and the four elements of our executive compensation packages included annual salary, aprogram, including the mix of cash and stock-based compensation, mix of short-term (annual) stock incentive award, and a long-term stock incentive award.compensation, and mix of service-based and performance-based compensation to determine whether they are appropriate relative to operational objectives and long-term performance of the Company. Annual Salary Annual salary is intended to provide competitive, fixed compensation to attract and retain executive talent with the skills and specific expertise needed to support the achievement of annual and long-term business objectives. Each year, the Compensation Committee approves the annual salaries for each of the Named Executive Officers, who may or may not receive a salary increase in any given year. In considering the annual salaries for the Named Executive Officers, the Committee reviews the Peer Group and Radford Survey, internal annual and multi-year business plans and performance, and general economic conditions in the context of our objectives for executive compensation.

| | | | | | | | | | Analysis Executive Officer Compensation | | Table of Contents |

Annual salary represents the single fixed component of the three principal elements of our executive compensation program and is intended to provide a baseline minimum amount of annual compensation for our executives. In January 2022,February 2023, the Compensation Committee approved maintaining Mr. Marr’s annual salaries for Mr. Marr and for Mr. Puckett, who received an increase in 2021 of 11.1% associated with his promotion to COO and confirmation by the Board of Directors as an executive officer in May 2021.salary. The Committee approved annual salary increases to Mr. Moore, Mr. Miller, and Mr. MillerPuckett of 14.3%12.5%, 2.4%, and 3.8%, respectively; the first salary increases for each Named Executive Officer since February 2020.8.3% respectively. | | John S. Marr, Jr. | | | 0.0% | | | $300,000 | | | $300,000 | | | | H. Lynn Moore, Jr. | | | 14.3% | | | $525,000 | | | $600,000 | | | | Brian K. Miller | | | 3.8% | | | $400,000 | | | $415,000 | | | | Jeffrey D. Puckett | | | 0.0% | | | $300,000 | | | $300,000 | |

| | | | | | | | | | | | | | | | Name | Increase

(%) | 2022

($) | 2023

($) | | | | | | | | John S. Marr, Jr. | — | | 300,000 | | 300,000 | | | | H. Lynn Moore, Jr. | 12.5 | | 600,000 | | 675,000 | | | | Brian K. Miller | 2.4 | | 415,000 | | 425,000 | | | | Jeffrey D. Puckett | 8.3 | | 300,000 | | 325,000 | | |

The review and approval of increases by our Compensation Committee for Mr. Moore and Mr. Miller was based on multiple factors. First, the Committee reviewed the Peer Group and Radford Survey data, which included comparisons for comparable roles in similar-sized companies with annual revenues between $900 million and $2.5$2.6 billion. The Compensation Committee also considered individual and Company performance in the previous fiscal year executive experience, retention, and against multi-year goals including Tyler’s growth in both revenue, operating margin, and earnings per share in independently assessing 2022 annual salary levels.share. In addition, the Compensation Committee applied its philosophies regarding “at risk” relative to fixedconsidered executive experience and retention as well as the balance between service-based and performance-based, compensation as part of an executive’s overall compensation mix in balancing the justification for a relative increase while maintaining the fixedtotal target compensation componentat or below Peer Group and Radford Survey benchmarks. This includes an evaluation of the impact of annual salary increases on annual incentive compensation and total compensation. The increased2023 annual salary approved by the Committee for 2022 is 19%Mr. Moore was 10% below both the Tyler Peer Group and 10%Radford survey median. The 2023 approved annual salary for Mr. Miller was 11% below the Tyler Peer Group median and is 20% and 13%15% below the Radford Survey medianmedian. There are no peers to our COO in the Tyler Peer Group; however, the 2023 approved annual salary for our CEO and CFO, respectively.Mr. Puckett was 23% below the Radford Survey benchmark for COOs. As noted above, the Compensation Committee does not adhere to strict formulas or rely, to any significant extent, on market survey data to determine total compensation or the mix of compensation elements.compensation. Market survey data is not used as a benchmark per se, but rather is referred to by the Compensation Committee as a reasonableness check. As noted above, the Committee’s long-standing philosophy remains positioning compensation toward performance-based over fixed pay for our Named Executive Officers. Short-term Incentives Short-term incentives are the second element of NEO compensation, intended to reward the achievement of short-term objectives which, when consistently achieved, drive long-term shareholder value. We believe that a meaningful portion of the executive’sexecutive compensation should be contingent upon the successful achievement of our annual corporate objectives, which represent annual components of our long-term growth strategy. While our short-term incentive compensation plan is based on a given year’s non-GAAP earnings per share, the initial establishment ofsetting the criteria for full achievement of the target bonus from year to year is based on a multi-year view of appropriate growth levels. In other words, performance that meets our internal plan in a given year may not necessarily correspond with our executives earning 100% of the target bonus if the internal plan does not meet the goal of overall year-over-year growth. The short-term incentive plan is based on our operating plan, which is driven by our multi-year plan and developed from the “bottom-up” and considers“bottom-up,” considering a wide range of factors that impact our results including the(the general economic environment,environment; our market, competitive landscape, initiatives and investments,investments; and various other risks and opportunities.opportunities). | | | | | | | | | | 58 | | | | | | | | 20232024 Proxy Statement 41

| |

TABLE OF CONTENTS

| | | | | | | | | | Analysis Executive Officer Compensation | | Table of Contents |

In February 2020, the Compensation Committee approved the change from a cash-based to a stock-based short-term incentive plan in the form of PSUs, which vest only upon the attainment of short-term performance objectives established for the plan. The Committee believescontinues to believe equity-based short-term incentives align executives with shareholder interests and company performance which increases long-term value for our shareholders. Each year, the Compensation Committee approves the vesting of annualshort-term incentive compensation PSUs for the prior fiscal year based on the achievement of definedpre-defined and pre-approved incentive compensation performance objectives that were approved by the Compensation Committee at the beginning of the prior fiscal year.objectives. Short-term incentives for the prior fiscal year are reviewed by the Compensation Committee in the first quarter of the following fiscal year and generally vest as earned on March 1. While the vesting of short-term incentive PSUs is based solely on the achievement of pre-defined and pre-approved performance objectives, the Compensation Committee, using its judgment, may exercise discretion in granting additional bonus amounts and equity awards as it deems appropriate. These adjustments may be based on subjective factors, such as the Compensation Committee’s assessment of external factors, including general economic and market conditions,conditions; unforeseen “one-time” events affecting financial performance or driving shareholder value,value; the executive’s assumption of additional responsibilities,responsibilities; the degree of difficulty of a particular assignment,assignment; and the executive’s experience, tenure, and future prospects with Tyler. The 20222023 short-term incentive compensation plan was based on annual non-GAAP earnings per share and is structured with graduated benefits for over-achievement and consequences for underachievementunder-achievement of objectives, including no vesting below a minimum threshold of performance. | | | | | |

| Annual Incentive Metric | | | Rationale for Metric | | | | | | | Non-GAAP Earnings per Share* | | | We believe that non-GAAP earnings per share removes certain uncontrollable variables and provides a more accurate picture of our financial performance. | |

*

| Excludes write-downs of acquisition-related deferred revenue and acquired leases, share-based compensation expense, employer portion of payroll taxes on employee stock transactions, acquisition-related costs, lease restructuring costs and other asset write-offs, and expenses associated with amortization of intangibles arising from business combinations. |

*Excludes write-downs of acquisition-related deferred revenue and acquired leases, share-based compensation expense, employer portion of payroll taxes on employee stock transactions, acquisition-related costs, lease restructuring costs and other asset write-offs, and expenses associated with amortization of intangibles arising from business combinations. In January 2022,February 2023, the Compensation Committee approved the 20222023 Short-Term Incentive Compensation Plan recommended by the Chief Executive Officer, which was based on the achievement of fully diluted non-GAAP earnings per share goals established in connection with our annual operating plan and consistent with our long-term growth strategy, (which excludes write-downs of acquisition-related deferred revenue and acquired leases, share-based compensation expense, employer portion of payroll taxes on employee stock transactions, acquisition-related costs, lease restructuring costs and other asset write-offs, and expenses associatedconsistent with the amortization of acquisition intangibles arising from business combinations and did not include any individual performance goals).chart above. The 20222023 Short-Term Incentive Compensation Plan performance objectives for the Named Executive Officers were similar to other corporate employees’ incentive compensation plans and tied to similar goals, the main difference being the size of the target incentive award in relation to base salary. We believe that the percentage of compensation that is based on our performance should increase with an employee’s level within the Company up to and including executive management. Target incentives are therefore determined based on experience, level of responsibility, and retention risk.

| | | | | | | | | | Analysis Executive Officer Compensation | | Table of Contents |

The 20222023 Short-Term Incentive Compensation Plan provided the opportunity for the executive officers, as well as other corporate employees, to earn incentive compensation at the following levels: 175% of target based on achieving 108.1% of adjusted earnings per share goal

170% of target based on achieving 107.6% of adjusted earnings per share goal

165% of target based on achieving 107.0% of adjusted earnings per share goal

160% of target based on achieving 106.5% of adjusted earnings per share goal

155% of target based on achieving 105.9% of adjusted earnings per share goal

150% of target based on achieving 105.4% of adjusted earnings per share goal

145% of target based on achieving 104.9% of adjusted earnings per share goal

140% of target based on achieving 104.3% of adjusted earnings per share goal

135% of target based on achieving 103.8% of adjusted earnings per share goal

130% of target based on achieving 103.2% of adjusted earnings per share goal

125% of target based on achieving 102.7% of adjusted earnings per share goal

120% of target based on achieving 102.2% of adjusted earnings per share goal

115% of target based on achieving 101.6% of adjusted earnings per share goal

110% of target based on achieving 101.1% of adjusted earnings per share goal

105% of target based on achieving 100.5% of adjusted earnings per share goal

100% of target based on achieving 100.0% of adjusted earnings per share goal

| | | | | | | | | | | | | | | | Percentage of EPS Goal (%) | | | Percentage of Target Award Earned (%) | | | | | | | | | | | 107.9 and above | | 42

175 | | | 107.4 to 107.89 | | 170 | | | 106.9 to 107.39 | | 165 | | | 106.4 to 106.89 | | 2023 Proxy Statement

160 | | | 105.8 to 106.39 | | 155 | | | 105.3 to 105.79 | | 150 | | | 104.8 to 105.29 | | 145 | | | 104.2 to 104.79 | | 140 | | | 103.7 to 104.19 | | 135 | | | 103.2 to 103.69 | | 130 | | | 102.6 to 103.19 | | 125 | | | 102.1 to 102.59 | | 120 | | | 101.6 to 102.09 | | 115 | | | 101.1 to 101.59 | | 110 | | | 100.5 to 101.09 | | 105 | | | 100.0 to 100.49 | | 100 | | | 99.5 to 99.99 | | 95 | | | 98.9 to 99.49 | | 90 | | | 98.4 to 98.89 | | 85 | | | 97.9 to 98.39 | | 80 | | | 97.4 to 97.89 | | 75 | | | 96.8 to 97.39 | | 70 | | | 96.3 to 96.79 | | 65 | | | 95.8 to 96.29 | | 60 | | | 95.2 to 95.79 | | 55 | | | 94.7 to 95.19 | | 50 | | | 94.2 to 94.69 | | 45 | | | 93.6 to 94.19 | | 40 | | | Less than 93.6 | | 0 | |

TABLE OF CONTENTS

95% of target based on achieving 99.5% of adjusted earnings per share goal

90% of target based on achieving 98.9% of adjusted earnings per share goal

85% of target based on achieving 98.4% of adjusted earnings per share goal

80% of target based on achieving 97.8% of adjusted earnings per share goal

75% of target based on achieving 97.3% of adjusted earnings per share goal

70% of target based on achieving 96.8% of adjusted earnings per share goal

65% of target based on achieving 96.2% of adjusted earnings per share goal

60% of target based on achieving 95.7% of adjusted earnings per share goal

55% of target based on achieving 95.1% of adjusted earnings per share goal

50% of target based on achieving 94.6% of adjusted earnings per share goal

45% of target based on achieving 94.1% of adjusted earnings per share goal

40% of target based on achieving 93.5% of adjusted earnings per share goal

In January 2023,February 2024, the Compensation Committee approved vesting of the 20222023 short-term incentive awards at 110%125% of base salary for Mr. Moore, Mr. Miller, and Mr. Puckett. Equity awards under the 20222023 Short-Term Incentive Compensation Plan vested on March 1, 2023,2024, as approved. | | Non-GAAP EPS* | | | $6.93 | | | $7.41 to $7.449 | | | $8.01 | | | $7.50 | | | 110% | |

| | | | | | | | | | | | | | | | | | | | | | Metric | Threshold (40%)

($) | Target (100%)

($) | Max (175%)

($) | Actual Achievement ($) | % of Target Achieved (%)(1) | | | | | | | | | Non-GAAP EPS(2) | 7.07 | | 7.55 to 7.589 | 8.15 | | 7.80 | | 125 | |

1.Represents the highest award payable without exceeding the expense limit for the performance range. | *

| | | | | | | | | Included adjustments to 2022 GAAP pre-tax income for (i) $1.9 million of acquisition- related costs, (ii) $104.6 million of share-based compensation expense and employer portion of payroll taxes on employee stock transactions, (iii) $113.6 million of amortization of intangibles arising from business combinations, and (iv) $2.8 million of lease restructuring and other asset write-offs.60 | 2024 Proxy Statement |

| | | | | | | | | | Analysis Executive Officer Compensation | | Table of Contents |

2.Included adjustments to 2023 GAAP pre-tax income for (i) $0.4 million of acquisition- related costs, (ii) $110.2 million of share-based compensation expense and employer portion of payroll taxes on employee stock transactions, (iii) $110.7 million of amortization of intangibles arising from business combinations, and (iv) $8.2 million of lease restructuring and other asset write-offs. Long-term Incentives The third componentand fourth components of our Named Executive Officers’ 20222023 compensation wasare provided as long-term stock incentives, including PSUs and stock options.incentives. We believe stock incentives provide a vital link between the long-term results achieved for our shareholders and the rewards provided to executive officers and other key employees for that achievement. Long-term equity incentives for 20222023 were comprised of stock optionsPSUs and PSUs andRSUs intended to reward sustained achievement of long-term objectives through achievement of performance goals and time-based vesting periods. Stock options granted to our executive officers have a ten-year life. Beginning in 2016, options vest ratably over a three-year period for employees (including Named Executive Officers) who are at least 50 years of age and have tenure with the Company of at least 15 years; otherwise, options vest ratably over a four-year period. Beginning in 2018,Long-term PSUs cliff-vest at the end of three years upon the achievement of defined performance measures as determined by the Compensation Committee. Our allocations reflect our philosophy that a significant portion of our executive officers’ compensation should be performance-based and therefore at risk depending on the Company’s performance.RSUs vest one-third each year over three years from grant date. Through the use of equity incentives, a significant portion of potential compensation is tied directly to achievement of performance goals or stock price appreciation, further aligning the interest of our executive officers with those of our shareholders. Stock options are granted in semi-annual tranches (on or about June 1In 2023, long-term PSUs represented approximately 70% of target total compensation to our Named Executive Officers. PSUs and December 1), and PSUsRSUs are granted on or about March 1 after performance metrics have been established. Stock option awards are granted with an exercise price equal to the market price at the time of the award. Our objectives in granting equity incentive awards are to: maintain•Maintain an overall number and value of equity incentive awards that is reasonable in terms of shareholder dilution;

focus•Focus equity incentive awards on a limited number of key employees who have a direct impact on our ability to achieve our long-term goals;

provide•Provide the largest equity incentive grants to our top performers and individuals with the greatest responsibilities and potential to drive long-term share price appreciation; and

utilize•Utilize a mix of options, restricted stock units and performance-based restricted stock units to align recipients with the long-term interests of our shareholders, without promoting excessingexcessive risk taking.

In setting the mix between the different elements of compensation, we do not target specific allocations, but generally weigh incentive compensation elements more heavily. For more information, see “Compensation Discussion and Analysis — 20222023 Named Executive Officer Compensation Structure and Process — Compensation Mix” below. For 2022,2023, the Compensation Committee approved grants of PSUs for 6,5002,810 shares for Mr. Marr; 20,306 shares for Mr. Moore; 3,7509,542 shares for Mr. Miller; and 2,5005,934 shares for Mr. Puckett. This represents an increase in PSUs granted in 2022 versus 2021 of 1,500; 417;2,810; 13,806; 5,792; and 1503,434 shares, respectively. This increase was due to the elimination, at the present time, of the previous practice of granting stock options in addition to PSUs. The Committee felt the increased number of shares and resulting target long-term incentive compensation provided an appropriate level of compensation for each Named Executive Officer in light of Company and individual performance as well as Peer Group analysis. | | | | | | | | | | 2023 Proxy Statement 43

| |

TABLE OF CONTENTS

Mr. Marr received no PSUs in his role as Executive Chair in 2022.

These grants to the Named Executive Officers, and therefore the actual number of PSUs that vest, are subject to performance-based vesting with a performance period of three years. The performance measuremeasures used to determine the number of PSUs vested at the end of the three-year performance period for the 20222023 PSU grant isare recurring revenue growth over that period. period and 2025 operating margin. The three-year cliff vesting period reinforces the importance of sustained recurring revenue and operating margin growth to the Company’s long-term success. The Compensation Committee believes that this vesting schedule emphasizes the long-term nature of this compensation component, thereby further aligning the interests of the Named Executive Officers with those of the shareholders. Upon vesting, the vested PSUs will be “settled” by our issuance to the holder, without any charge, of one share of our common stock for each vested PSU.

| | | | | | | | | | Analysis Executive Officer Compensation | | Table of Contents |

The following tabletables sets forth the performance criteria that must be met for annual PSU grants to be earned and eligible for vesting: | | | | | | | | | 3-Year Cumulative Recurring

Revenue Growth(1) | | | Percentage of PSUs

to be earned and

eligible for vesting (%) | | | | | | Under 28.9% | — | | | | 28.9% to 32.89% | 50 | | | | 32.9% to 36.89% | 80 | | | | 36.9% to 42.89% | 100 | | | | 42.9% to 46.89% | 120 | | | | 46.9% and above | 150 | | |